BLOG

INTERESTING STUFF

THAT CAUGHT OUR EYE

Guest Expert: Donald Trump and the Next Boom in Property Prices

This month, we invited Jeremy McGivern from Mercury Homesearch – trusted advisers to the world’s most successful families and business people – to give his latest insight on London’s property market and how it’s affected by the tumultuous political situation here and abroad.

Donald Trump is not an idiot.

He is extremely good at getting what he wants.

So, what do you think he really wants now?

To win a second term as president! Now the thought of this sends many people into either a cold sweat or apoplectic rage. But when you consider what he is currently doing, this actually bodes extremely well for property prices.

And before you write in saying that there is more to life than property prices, you are absolutely right. But my remit is to guide you as to what is happening in the prime central London property market. So, I am not making any moral judgements; I am just trying to show you how the property cycle will repeat as it has done for 400 years in the U.K. and over 200 years in the U.S.

So how is Trump setting up the next boom in property prices?

Well, the first thing to note is that the UK & US property markets are founded on the same principles so the cycles repeat in the same way and almost simultaneously.

The first half of each cycle is dominated by fear because everyone is scarred by the crash that marks the end of one cycle and the beginning of the next, e.g. 1990 and 2008. When property prices recovered after both these crashes (1990 was worse in terms of property in the U.K.). the prevailing sentiment was/is that prices were/are too high and that another crash was needed/due.

This is exactly where we are now. As legendary investor Sir John Templeton noted bull markets are “founded on pessimism, grown on scepticism, matured on optimism and end in euphoria”.

Currently, scepticism about property prices is at an all-time high. Let’s look at some of the concerns:

- Brexit

- The U.S. trade war with China

- Potential interest rate rises

- Wobbly stock markets

But this is pretty standard for the end of the first half of the cycle. Let’s take a look at the last cycle:

- 1998 – The Asian Tiger economies were imploding while the collapse of LTCM caused by the Russian Bond default meant that everyone thought the financial system would collapse.

- Y2K – the fear that the world’s computers would stop working and that planes would fall out of the sky

- 2000/2001 – The DotCom crash

- 2001 – 9/11 and the terrorist attacks in London

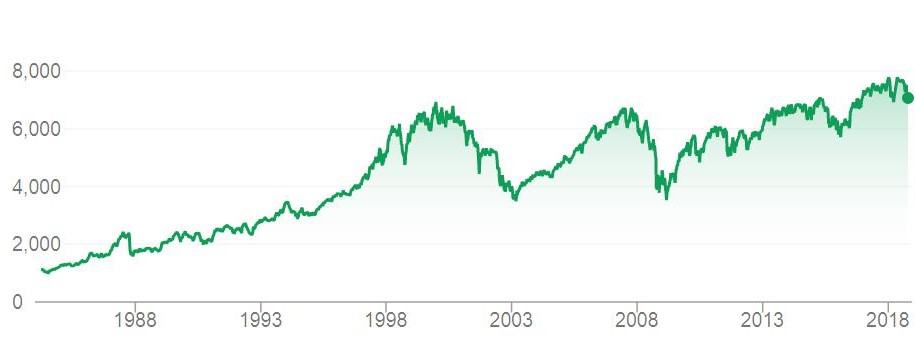

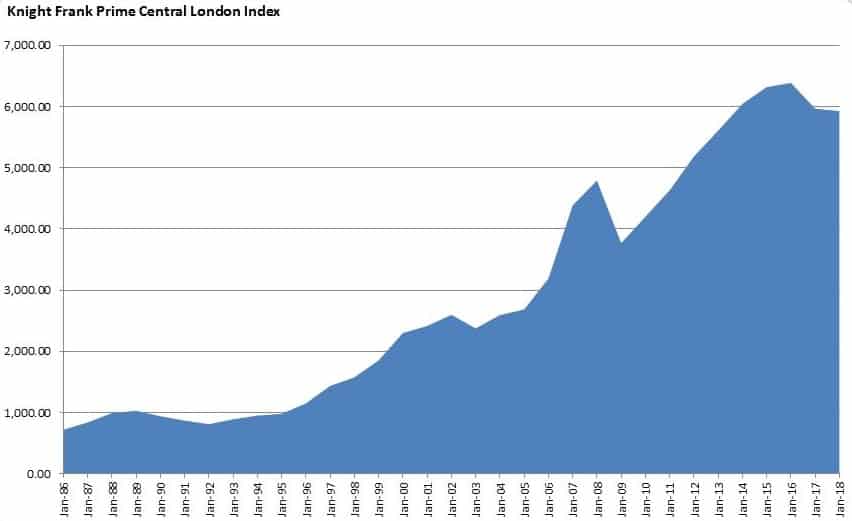

Pretty horrific. But look at these two charts:

FTSE Chart

As you can see, this had virtually no impact on prime London property prices and the recession in the U.S. was short and sharp – IT WAS NOT A REPEAT of 1990. Why? Because the banks had been recapitalised just as they are now.

This is important, because it means that if there is a recession or major stock market crash then policy makers can take action. Action which they were unable to take because in 1989 and 2007 everyone was fully invested and leveraged up to their eyeballs – in other words a completely different scenario to 2000 and now, because there is so much money sitting on the side lines.

So, what has Trump got to do with this?

Well in 2000 we had the Greenspan Put. This involved reducing interest rates and relaxing banking regulations to let more credit into the system.

There isn’t much room to reduce interest rates now, but there is a new weapon – Quantitative Easing. Yes, there is Quantitative tightening at the moment, but they can just as easily turn on the printing presses again and they will as it is the path of least resistance…

Likewise, they will also relax banking regulations. In fact, this has already started. Last year Trump and Congress voted through amendments to water down the Dodd Frank Act. This was a relaxation of the current rules for the smaller banks, but this was just the start.

Banking regulations will be relaxed further and it will be done to “help the man and woman in the street and small businesses”, which it will to a small degree, but the biggest effect will be on asset prices and property in particular.

And remember, Trump wants to get re-elected, so he will heed Clinton’s advice “It’s the economy, stupid!” and will follow the well-trodden path of boosting the economy in the run-up to next year’s election.

It is no co-incidence that the trade war with China was not started as soon as he became president. Do not be surprised if the U.S. and China reach an agreement in the second half of this year, which will help flagging figures in China and which will give a boost to the U.S. stock markets and economy just in time for the election next year (as I say this is a well-trodden path as history has proven that the third year of a first presidential term is good for U.S. stocks and the economy).

But what about Brexit?

Well, despite the scare stories being propagated by both sides of the argument, the political buffoonery will have no lasting effect. We have seen this before – in 1992 the U.K. crashed out of the European Exchange Rate Mechanism.

This was a shock (unlike Brexit which has dragged on…) and, at the time, was seen as the end for the U.K., because it was on the back of the massive property crash of 1990. In other words, a far worse economic scenario than the one we are currently in. Yet property prices in London started increasing the next year.

Indeed, rather than being swamped by the subjective opinion pieces spouted in the press and the self-serving statements of various politicians, it pays to study what is actually happening because actions speak louder than words:

- In the first half of 2017 post the referendum, Chinese buyers spent 24% more on commercial property in London than they did in the first half of 2016 before the Referendum.

- Tech take-up in the City (Core and Fringe sub-markets) in 2017 was 65% up on the 10-year average – the highest level of take-up seen in the City by tech occupiers since the tech boom of 2000. (Savills)

- Foreign buyers spent more on the UK capital’s offices in the first half of 2018 than in central Paris, Manhattan, Munich and Frankfurt combined. (Knight Frank)

- Goldman Sachs has just sold its new office scheme for £1.2bn and will be renting it back. Goldman Sachs vice-chairman Richard Gnodde said the long lease “demonstrates our continued commitment to London”.

- Office take-up in London reached 14.61m sq. ft. last year, 14% higher than the long-term average… take up in 2018 was more than 5% higher than 2017” (Property Week)

- To appear in the 2018 Sunday Times Rich List, you needed a minimum of £115m. 4.5% more than in 2017 and 700% more than in 1998. In that time the FTSE has gone from 5,500 to 6,900.

Please note that I am not saying that Brexit will be a good or bad thing. I am merely highlighting that the property cycle is not affected by politics – we have had kings and queens of differing religious persuasions and ability, we have had political parties with varying beliefs run the country and yet the property cycle has repeated like clockwork for 400 years. With only two exceptions – the two World Wars.

By the way, what I have described so far is just the tip of the iceberg. There are several factors that will drive prices higher including crowdfunding, longer term mortgages and fintech. And consider this this: the last boom was fuelled in large part by Irish, Scottish and Icelandic banks. This time round, it will be Asian, Indian and US banks. In other words, a different league of credit creation.

There are several reactions to the current uncertainty:

There are those that believe the scare-mongering and who think that the UK will become a barren wasteland and that London will collapse in on itself.

Then there are those who want to “wait and see”. In other words, they are paralysed by the thought that London might implode even though this is an incredibly low probability event and history has proven otherwise. It is the equivalent of being happy to drive to an airport but not getting on a plane, despite the fact that it is categorically safer to fly (hopefully not famous last words as I am getting on a plane tomorrow!).

Then there are those like our members who are currently keen to buy a property, because they have studied the facts rather than relying on hearsay and opinion. Consequently, they see that now is an opportunity.

Yes, this goes against conventional wisdom, but if you had said that you were planning to buy a property in 2001, people would have sniggered and said you were mad then too, despite the fact that it was a great opportunity.

Unfortunately, crowds and popular opinion are swayed by emotions and “Groupthink” rather than facts, which is why Warren Buffett has warned investors to be “Greedy when others are fearful and fearful when others are greedy”. Bull markets die on euphoria/investor greed. We are nowhere near that phase as I am sure you can see.

Of course, this doesn’t mean that you should rush out to your nearest estate agent and buy a property. I know I repeat this incessantly, but it’s vital: you must be selective and stick to the best in breed strategy, so that you acquire a high-quality property that will outperform.

So, if you think that now represents a good opportunity to buy a home or investment in London and you would like to be “greedy while others are fearful”, then I urge you to take action and start actively looking for those opportunities, so that you are ahead of the crowd and all the money that is currently sitting idle on the side lines. If you wait to move with the crowd, you will have missed out.

Of course, you may have specific questions:

- How can you have first refusal on the best opportunities?

- How can you source off-market properties?

- What are the properties you should avoid buying?

- Which areas offer the most upside?

- How can you accurately value a property so that you don’t make an expensive mistake?

- How can you negotiate the lowest price possible?

If you know the answers then you should be actively looking. However, if you want these or other questions answered, then simply email your questions to veronika@mercuryhomesearch.com, so that we can give you the information you need to take advantage of the current market.

Jeremy McGivern